Dividends Pay Dividends

As this issue was being written, quality bonds were providing modest yields.1 U.S. Treasury notes, for example, were yielding between 0.15% for the two-year maturity and 0.65% for the ten-year note. These high-quality bonds, of course, provide other virtues: diversification, liquidity, and timely payments of interest and principal.

Meanwhile, many investors may be overlooking the importance of dividends over time. In fact, according to Morningstar, reinvested dividends accounted for 42% of the stock market’s return from 1930–2019, as measured by the S&P 500 Index.2 With growth stocks in particular, a rapidly growing dividend may be one of the most significant contributors to the success of an investment.

At Compass, we invest in high-quality stocks. One measurement of our claim of high-quality purchases is how our core stock companies have increased their dividends over time.

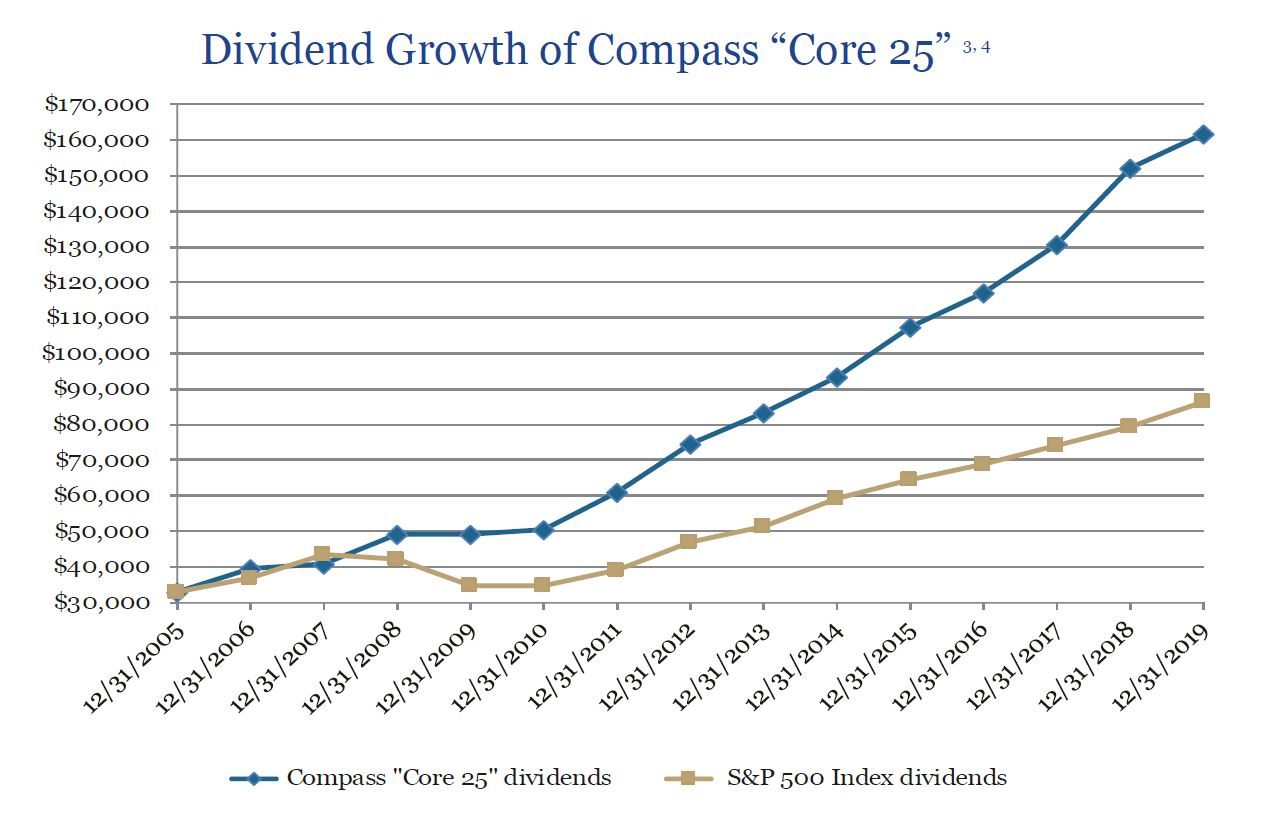

As shown in the chart below, Compass’s dividend income increased 12.01% per annum compared to the S&P 500 Index with an increase of 7.09% per annum (2005–2019).

For example, in a sample portfolio composed solely of Compass “Core 25” stocks , cash dividends paid in 2005 were approximately $33,000. By 2019, the dividend income had increased over five-fold to $161,000 (not including an additional $40,000 of special dividends paid). Moreover, the value of this sample portfolio over this period has more than tripled to $10.1 million!

So, what can we conclude from this? Using a rising dividend income stream, it appears our Compass core stock portfolio is quite healthy. Of course, rising dividends cannot assure investment success, nor would a sensible investor buy or sell stocks simply because a company pays a dividend. However, if growing income from growing dividends is a result of rising revenues, profits, and free cash-flow, it certainly improves the possibility of long-term success.

1June 1, 2020

2S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks. Indices are unmanaged and not available for direct investment.

3Past performance does not guarantee future results. For illustrative purposes only. Dividend-paying stocks are not guaranteed to outperform non-dividend paying stocks in a declining, flat, or rising market.

4Compass dividends based on actual client investment into Compass Core 25; reinvesting dividends, plus money market interest. Compass totals do not include approximately $40,230 of special dividends paid, whereas special dividends are included in the S&P 500 Index returns. S&P 500 Index dividends from Bloomberg.

Download PDF